The Rebate Claim form is used to create manual rebate credit note claims. When this form is used the rebate claim credit note is first created and then allocated to the applicable invoices before the payment is recorded.

This form should be used for all rebates claimed where you need to compare the rebate amount accrued per invoice and product to the rebate amount claimed.

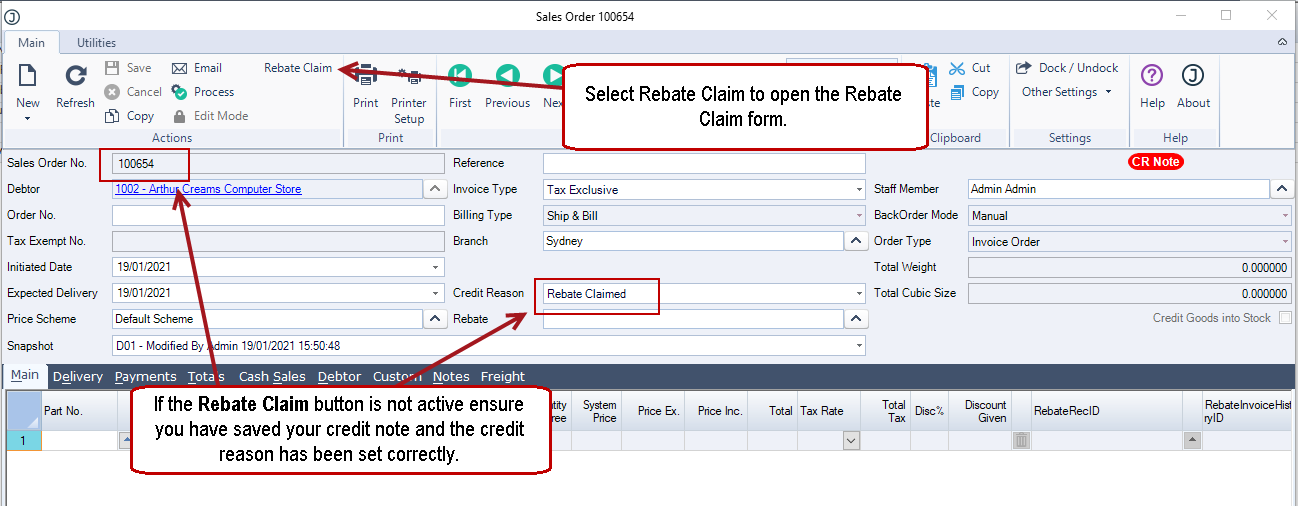

Creating Rebate Claim Credit Note

From the Sales Order entry form create a New Credit Note.

Select No at the Create a new credit note based on an existing sales order prompt.

Select your required customer.

Set your credit reason to Rebate Claimed.

Save your credit note.

Note 1: If the credit reason is not set to Rebate Claimed or the credit note has not been saved the Rebate Claim button on the menu ribbon will not be enabled.

Note 2: The rebate claim credit reason is controlled via the custom system setting RebateCreditReason. This allows users to select the required credit reason for all rebate credit claims.

From the menu ribbon select Rebate Claim

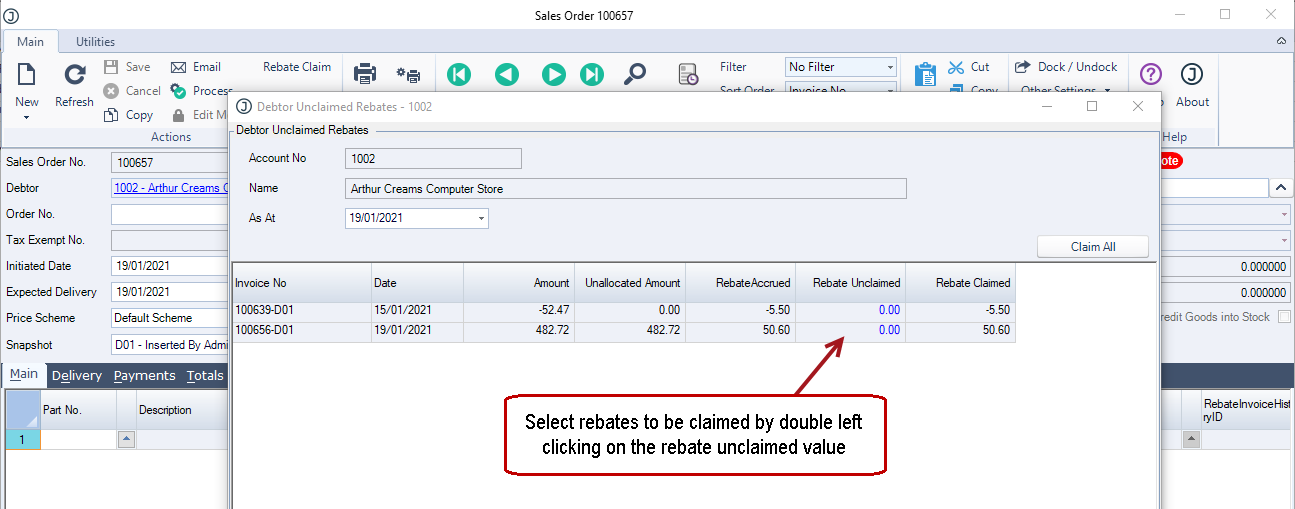

This will open the Debtor Unclaimed Rebates form that displays all rebates that have not been claimed.

The rebate value displayed is inclusive of GST.

Select the invoice/credit note rebates being claimed by double left clicking on the Rebate Unclaimed value.

If all rebates are being claimed simply click on the Claim All button.

When you are happy with your selections click on the OK button at the bottom of the form.

The Credit Note lines are automatically populated with the rebate claim values.

Note: Each line added to the credit note is linked to the originating invoice the rebate claim relates to.

Save and Process your credit note and allocate to applicable invoices.

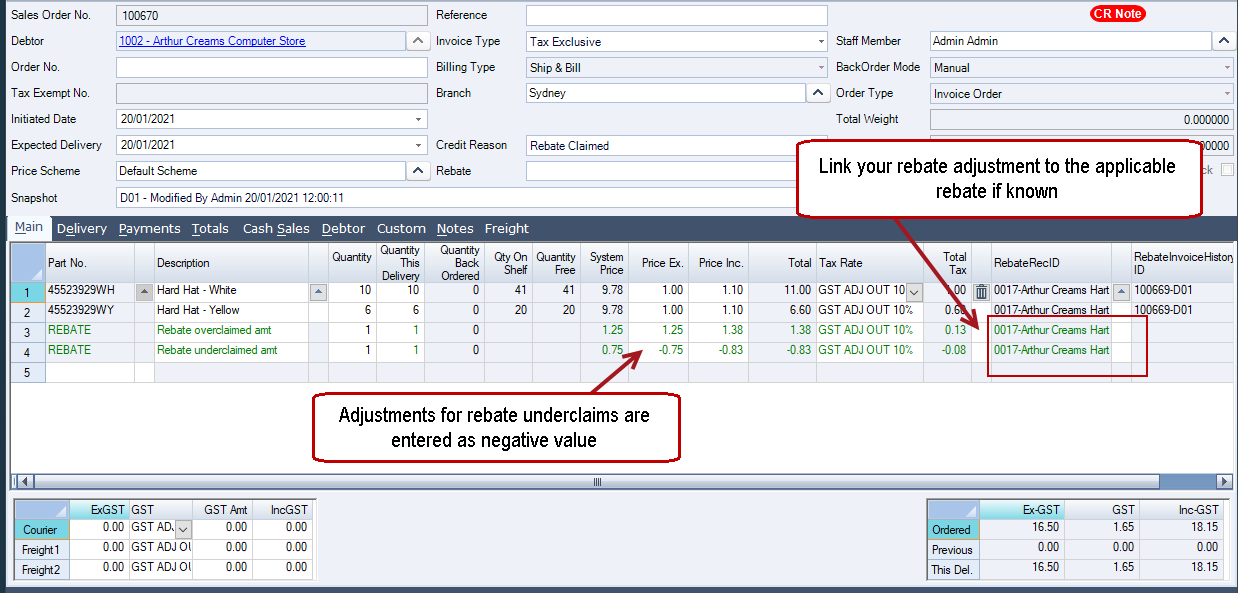

Rebate Over/Under Claims

Adjusting the Line Price Ex. Value

In cases where a rebate has been over or under claimed, the adjustment can be made to the rebate at the time the credit note is being created.

In cases where the over or under claim can be associated with a specific invoice and product, then the Price Ex. value can be changed to the value per unit actually being claimed.

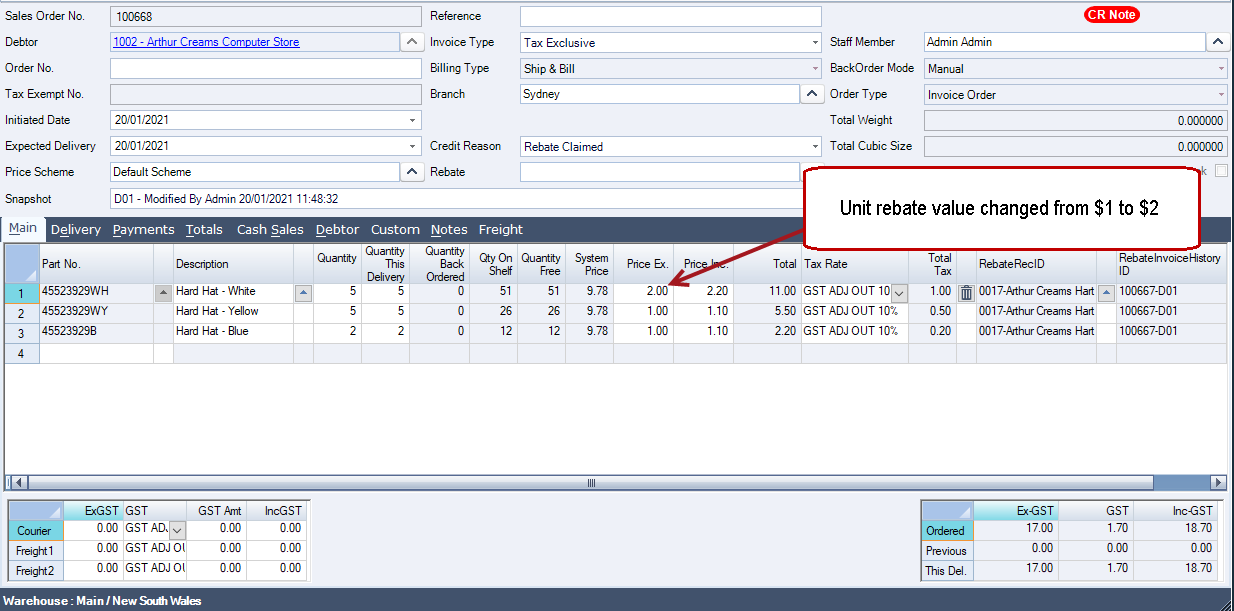

In the example below the Price Ex. value has been updated from $1 per unit to $2 per unit.

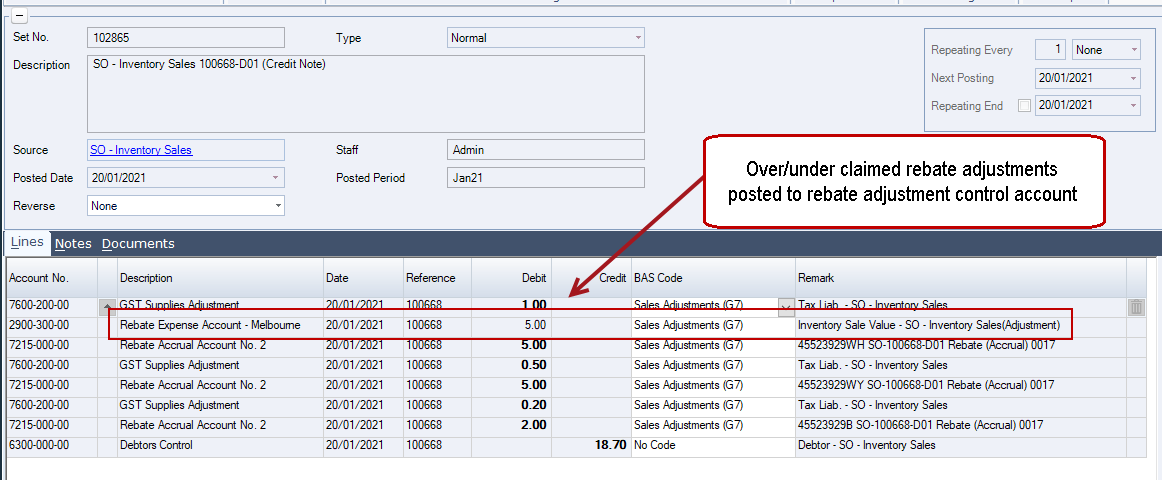

When the credit note is processed the journal set created correctly reverses the accrued amount and posts the over/under claimed value to the rebate expense control account.

Adding Adjustment Line for Over/Under Claims

In cases where the rebate over or under claim cannot be attributed to a specific invoice and product, then the credit note created can be adjusted by adding a non inventory line to the credit note.

Ensure that you link the rebate adjustment line to the applicable rebate.

Note: Ensure that the correct account is applied to the adjustment line

The example below demonstrates how an over and under claim is added to the credit note. In the case of under claim the Price Ex. value is entered as a negative amount as we want to reduce the value of the credit note issued by the amount being under claimed.