In this article we will look at how accruals are taken up for product and annual spend rebates.

Product Based Rebates

Rebates based on specific products or groups of products are accrued on the actual delivery quantities and not ordered quantities.

The rebate accrual is posted to the General Ledger on the processing of a sales order snapshot as this is when the actual delivery quantities are confirmed.

Annual Spend Rebates

Annual spend rebate accruals are based on the customers total sales value excluding GST. Credit notes related to stock are included in the total sales value however credit notes for rebates taken up are excluded from the calculation.

The rebate accrual is posted to the General Ledger overnight. The Jiwa scheduler service is setup to run the calculation process. This can be changed to post the accrual journals more frequently if required.

Rebate Accrual Journals

Sales Orders

When the sales order snapshot is processed to invoice, the journal created has been modified to include the rebate accrual where the accrual is product based.

The applicable accounts are taken from the control accounts assigned to the rebate campaign in the Rebate Maintenance form.

DR Rebate Expense Control Account

CR Rebate Accrual Control Account

The journal entry lines are assigned the BAS Code No Code.

Rebates stop accruing when maximum quantities are reached if maximum quantities have been set against the product rebate.

Processing Sales Order Snapshots

When the sales order snapshot is processed to invoice, the journal entry posted to the GL takes up the rebate accrual based on the This Delivery quantity.

The rebate accrual is taken up per product per rebate campaign.

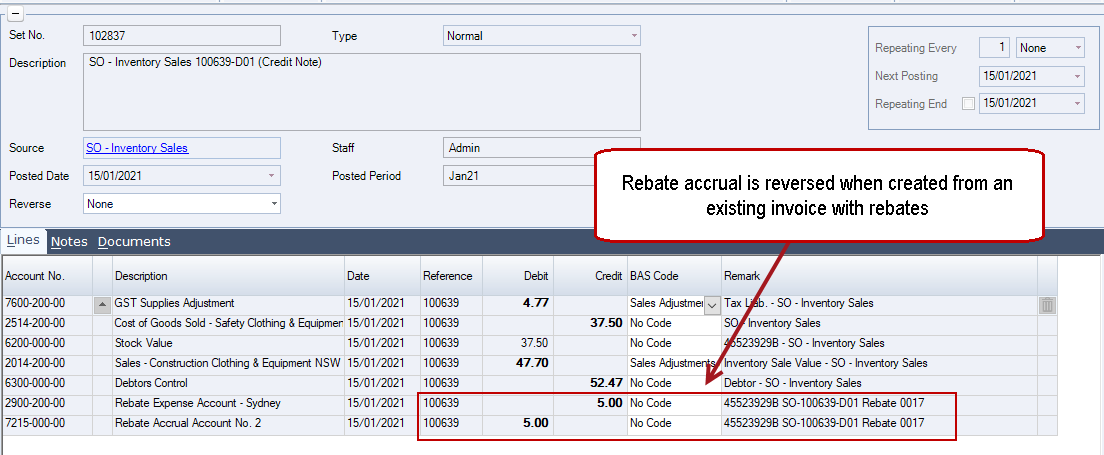

Credit Notes

When the Credit Note is processed for the return of stock or damaged stock the journal created has been modified to include the reversal of the rebate where the accrual is product based.

The applicable accounts are taken from the control accounts assigned to the rebate campaign in the Rebate Maintenance form.

DR Rebate Accrual Control Account

CR Rebate Expense Control Account

The journal entry lines are assigned the BAS Code No Code.

Processing Credit Notes

When the credit note for the return of stock or damaged stock is processed the journal entry posted to the General Ledger reverses any applicable rebates.

If maximum quantities are applicable these are updated to take into account the credit note.

Credit Notes Created Within the Rebate Period

If the credit note created within the rebate period is either based on an existing invoice or manually created then the applicable rebate accrued is reversed.

Credit Notes Created outside the Rebate Period

If the credit note created outside of the rebate period is based on an invoice which has a rebate accrual then the rebate is reversed based on the quantity being credited.

If the credit note created outside of the rebate period is created manually then there is no rebate reversal.