In this article we look at how direct and indirect costs such as labour and factory costs can be added to the total manufacturing cost of a product. We also look at the journal entries that are created during this process.

Before proceeding with this article we recommend that you,

- Have discussed your requirements with your Accountant,

- Have a clear understanding of what costs are to be recovered and on what basis,

- Have an understanding of the manufacturing process in Jiwa, and

- Have reviewed the following articles;

Overview

The total manufacturing cost of a finished product is not always just the cost of the component parts that are used in the manufacturing process, the total cost can also include direct and overhead expenses such as;

- Direct labour costs,

- Indirect labour costs,

- Facility maintenance expenses,

- Insurances

Before you start to add these recoveries to your manufacturing process we recommend that you consider the following.

We also highly recommend that you discuss recoveries with your Accountant in particular the following points as these will have an impact on how you account for your recoveries in Jiwa;

- What costs need to be recovered,

- How is your recovery rate calculated,

- On what basis are these costs recovered (fixed or ratio),

- What new inventory classifications if any are required,

- What new stock items if any are required, and

- How are recoveries to appear in the P&L

Stock Items

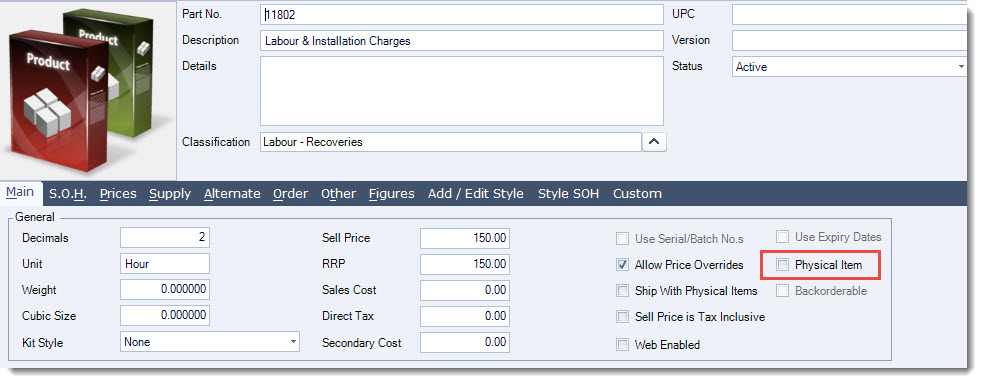

Non physical stock items need to be created for each type of cost to be recovered. The key points to take note of are;

The Physical Item check box is unchecked indicating that this item is a non-physical item

On the Prices tab you have set the Last Cost. This is the cost that will be used in the manufacturing process and should represent the cost you want to recover per unit or production batch.