The GL Global Review plugin is a new utility created by Opal Logic that enables Jiwa users to review source transactions by GST code.

This new utility has been designed to supplement the standard Jiwa tax reports which are generated from the General Ledger journal sets created by each transaction. The GL Global Review utility gives users the ability to review, add comments and drill down into the originating transaction from a single source, thus eliminating the need to run multiple reports.

In this article we look at the various form features and how to reconciliation the results to the standard Jiwa tax reports.

Form Overview

The GL Global Review form has three(3) key sections

- Summary,

- Ranges, and

- Transaction Detail

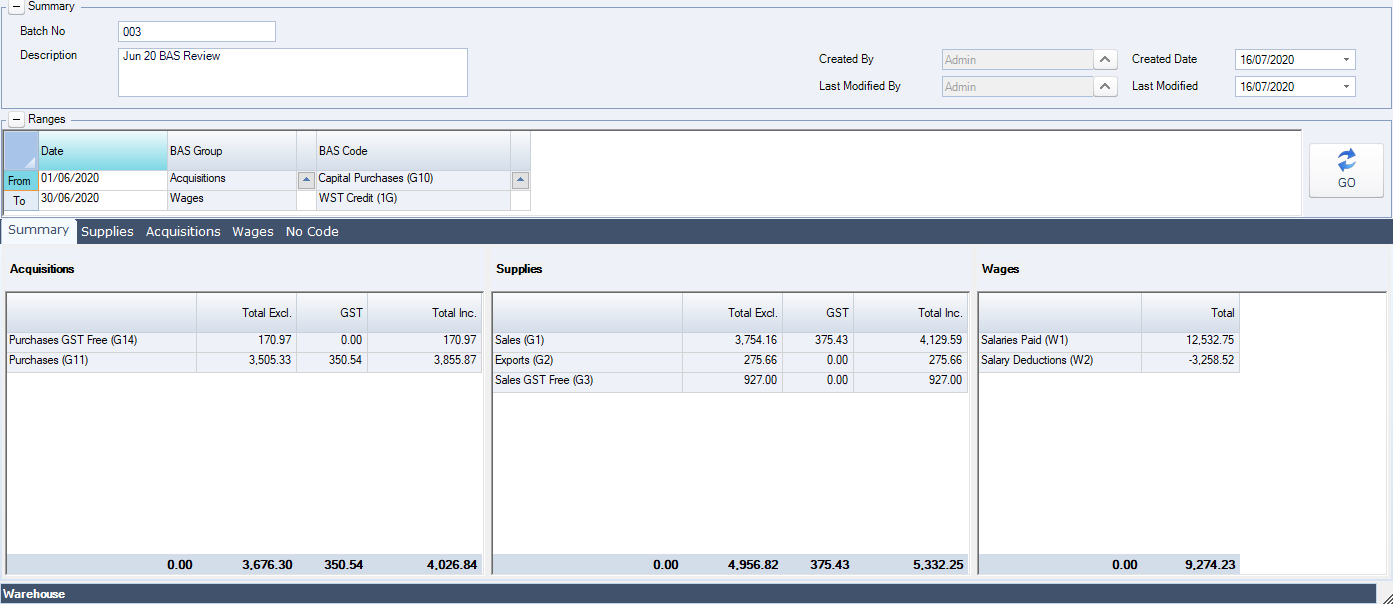

Summary

The Summary section of the form provides details of the review batch that has been created.

Only the description field is editable in this section.

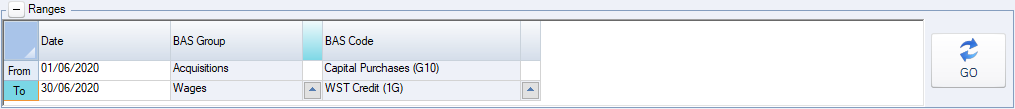

Ranges

The Ranges section of the form sets the filters that will be applied to the data returned to the transaction tabs once Go is selected.

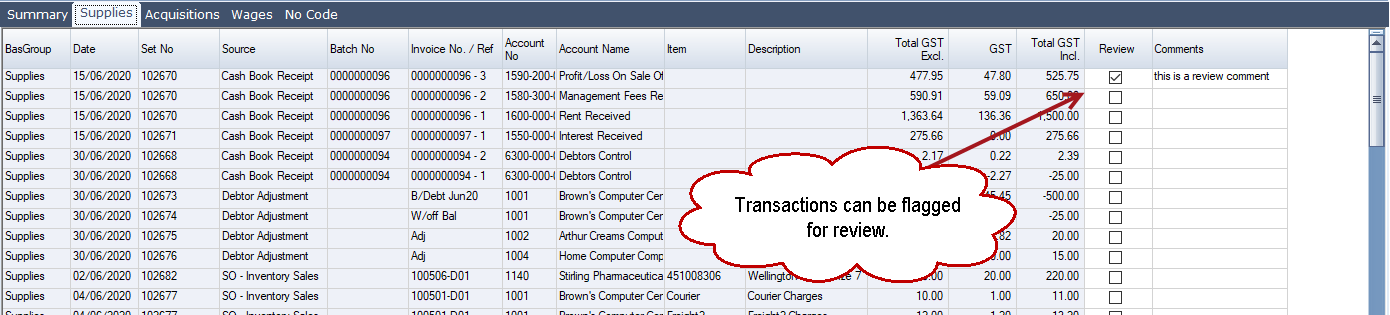

Transaction Detail Tabs

The Transaction detail section of the form displays all transactions returned based on the options set in the Ranges section.

The standard Jiwa Use Custom Columns options are available on all the tabs in this section.

Users can also drill down into the source transaction from all tabs except for the Summary tab.

| Tab | Description |

|---|---|

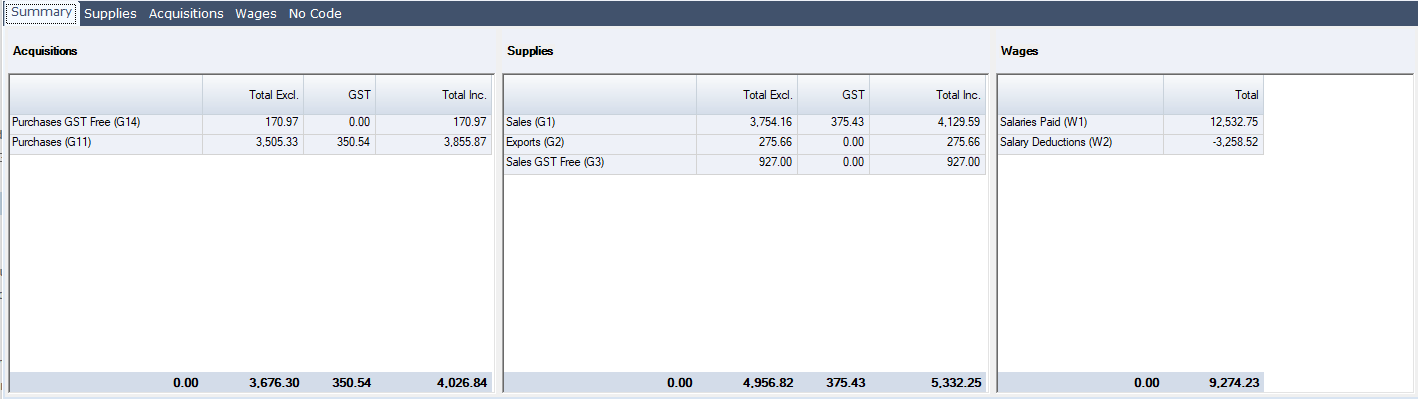

| Summary | This tab is a summary of the source transaction by BAS Group and code. |

| Supplies | This tab displays all the sale transactions that are linked to the BAS group Supplies. |

| Acquisitions | This tab displays all purchase related transactions that are linked to the BAS group Acquisitions |

| Wages | This tab displays all salary and wage transactions that are linked to the BAS wages related BAS codes |

| No Code | This tab displays all transactions that are not linked to non-reportable BAS codes. |

On the transaction detail tabs users can flag a transaction for review and add comments were required.

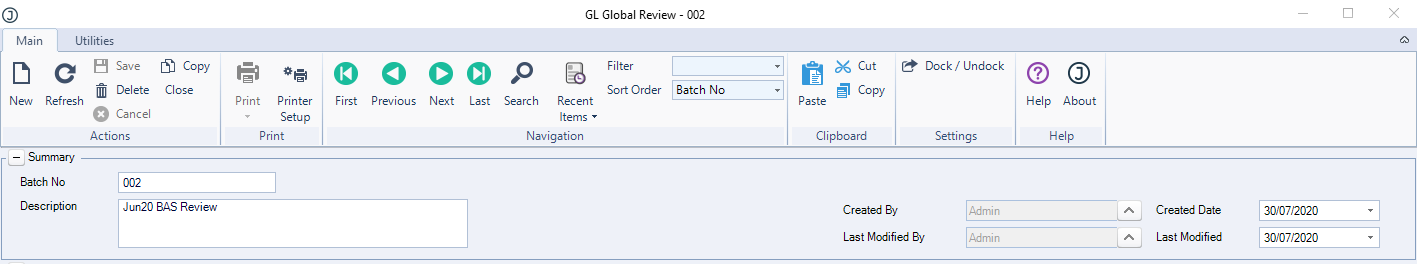

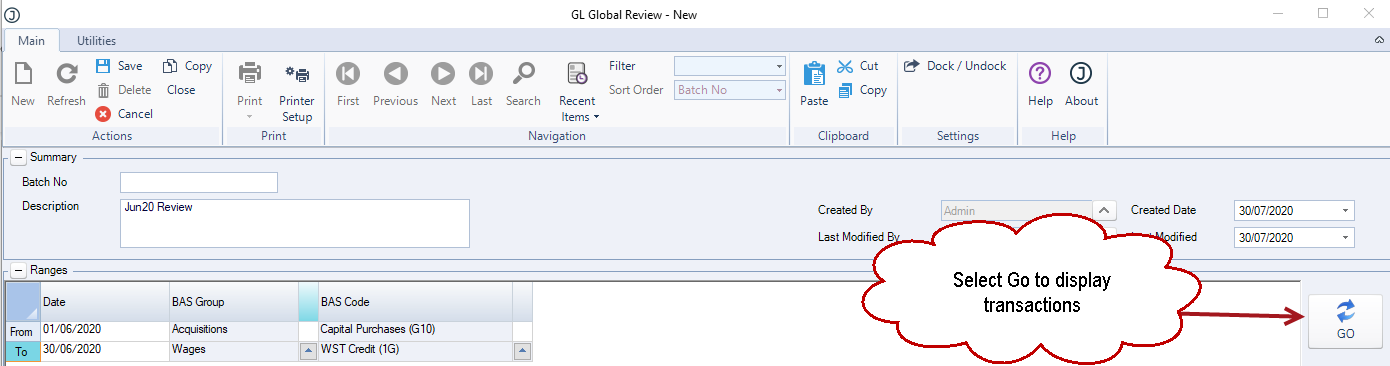

Creating a New Batch

Creating a review batch is a way in which users can capture transactions for a specific BAS reporting period. Once the BAS return has been lodged the batch can be closed from further editing.

Multiple batches can be created for a single BAS reporting period, this is useful if users need to retain review versions in additional to the final version.

To create a new batch from the menu ribbon select New.

Enter a comment on the purpose of the batch in the description field.

Set your range options and then press the Go button.

Save the batch and commence the review process by moving through each of the tabs.

Transactions with incorrect tax codes must be reversed and reentered with the correct tax code from the originating module. Transactions cannot be reversed from the GL Global Review utility.

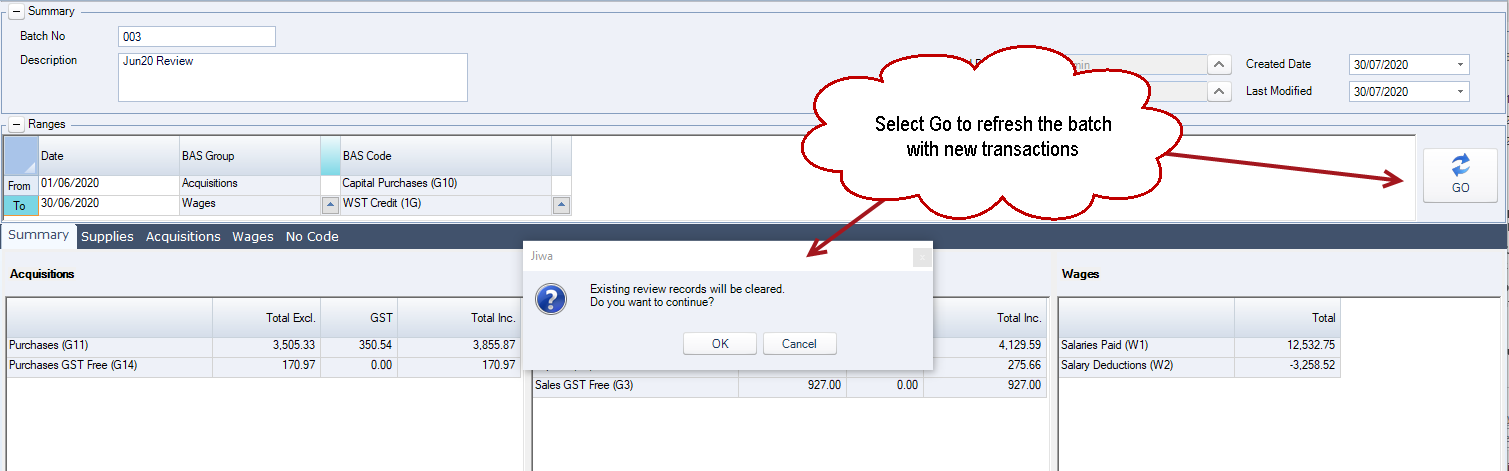

The batch must be refreshed to display any new transactions that have been created. Alternatively, a new batch can be created for the same reporting period.

From the ranges section select the Go button and then OK to the update popup.

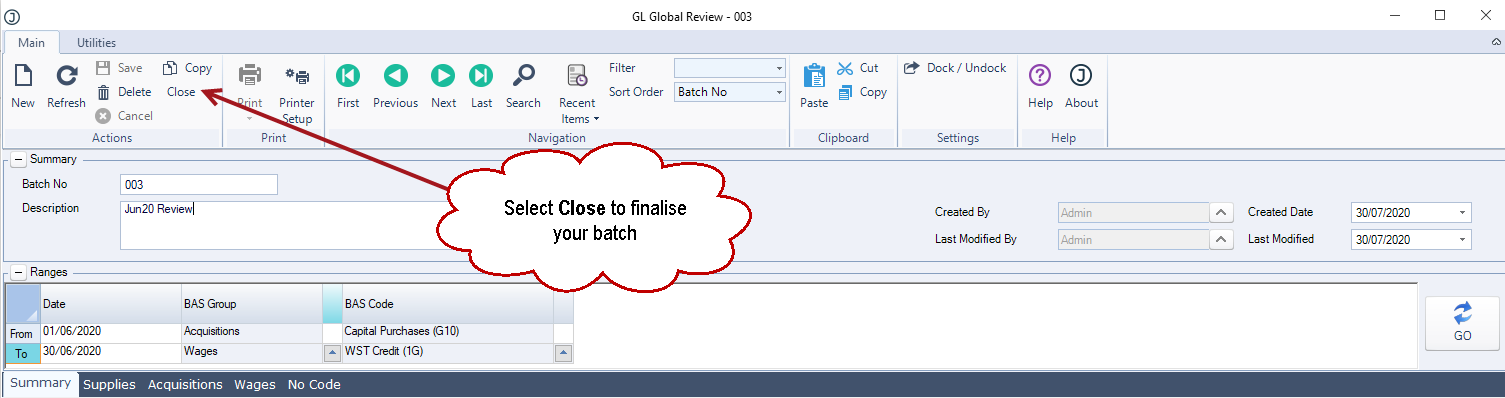

Once all transactions have been reviewed and the results reconciled to the standard Jiwa tax reports the batch can be closed by selecting the Close button on the menu ribbon.

The batch is now locked from further editing but can be re-opened by selecting the Re-open button

Reconciling Review Batch to Jiwa Tax Reports

Acquisitions

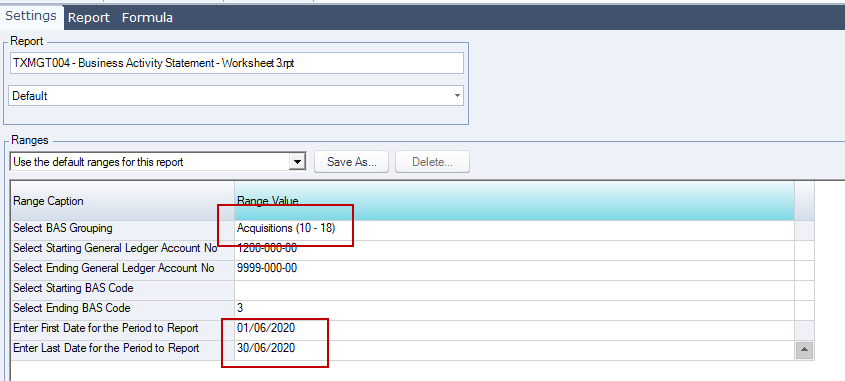

To reconcile your Acquisition values run the Business Activity Statement – Worksheet 3 report.

Ensure that you set your report range options to match the data being returned in your review batch.

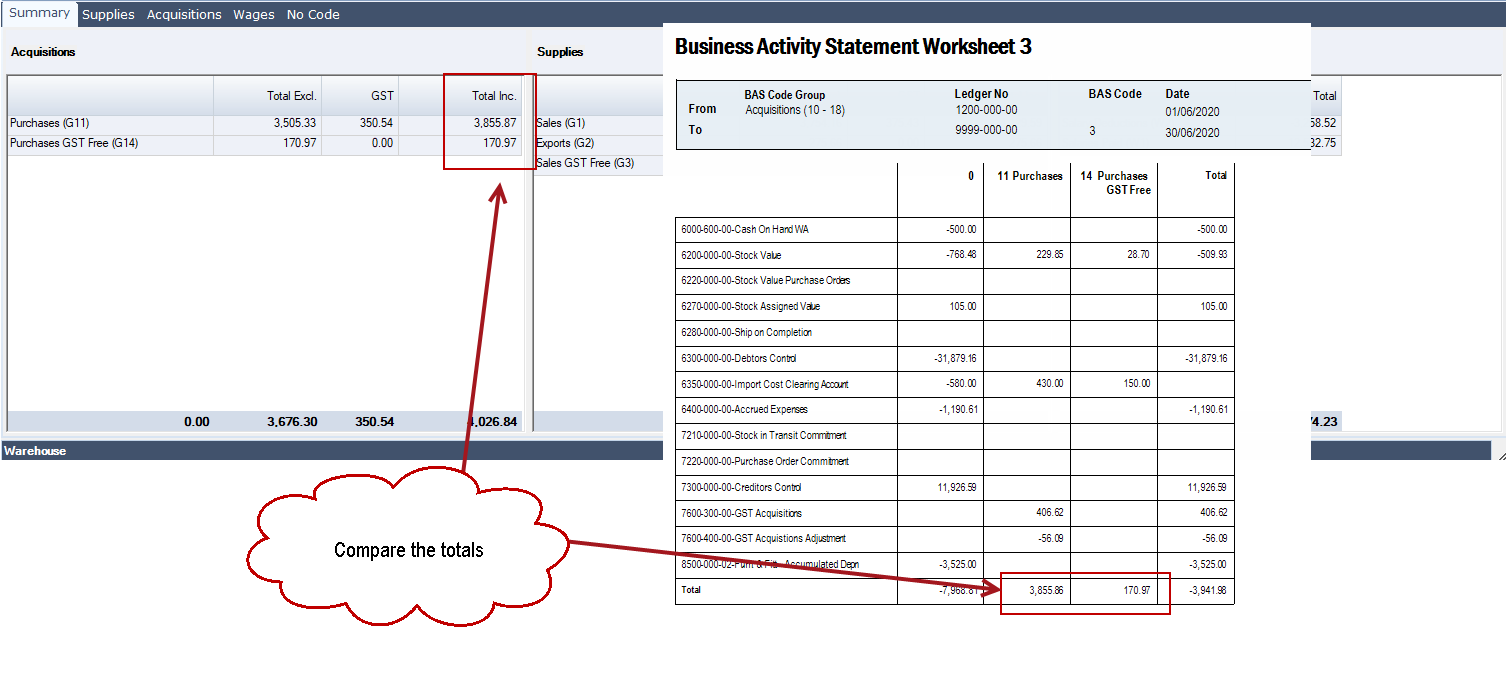

Compare the totals on the last page to the GST Inc totals on the summary tab of your batch.

The GL Global Review form pulls data from the source transactions whereas the BAS Worksheets only look at the journal sets created by the source transactions this difference may result in minor rounding variances. Significant variances should be investigated.

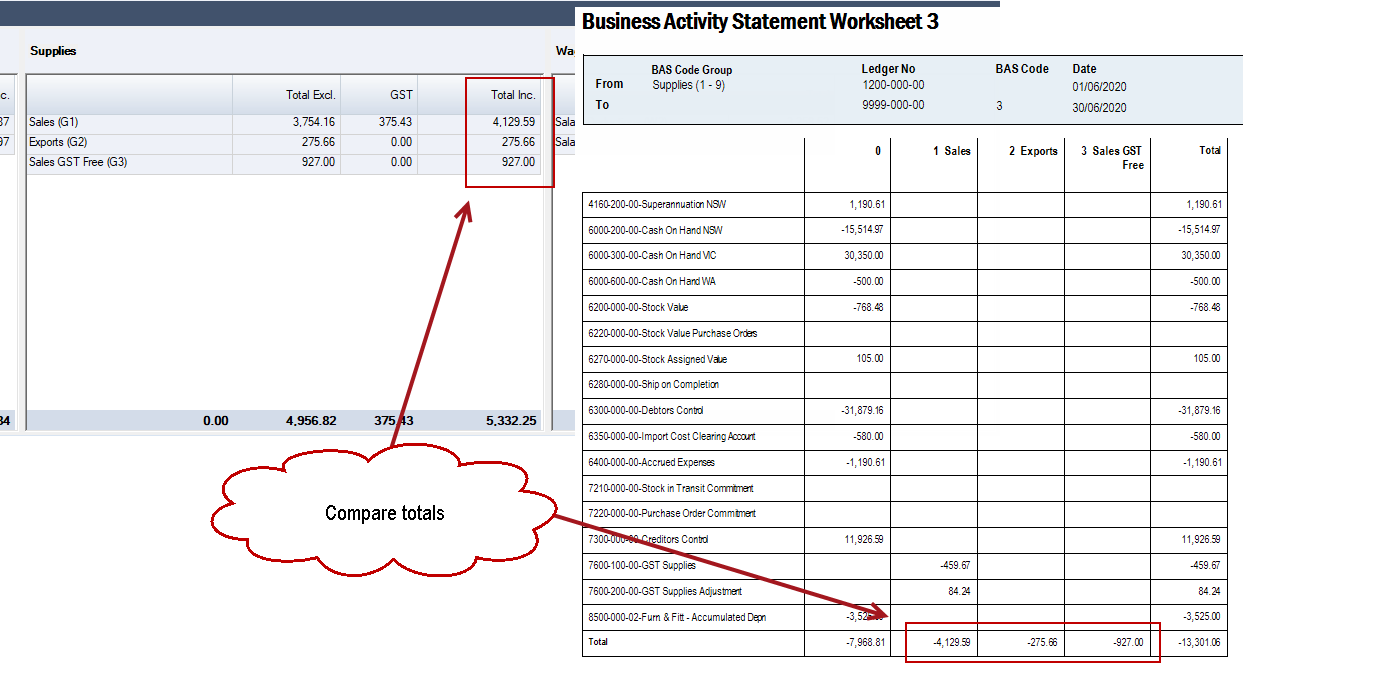

Supplies

To reconcile your Supply values run the Business Activity Statement – Worksheet 3 report again but this time set the BAS Grouping to Supplies (1 – 9)

Compare the totals on the last page to the GST Inc totals on the summary tab of your batch.

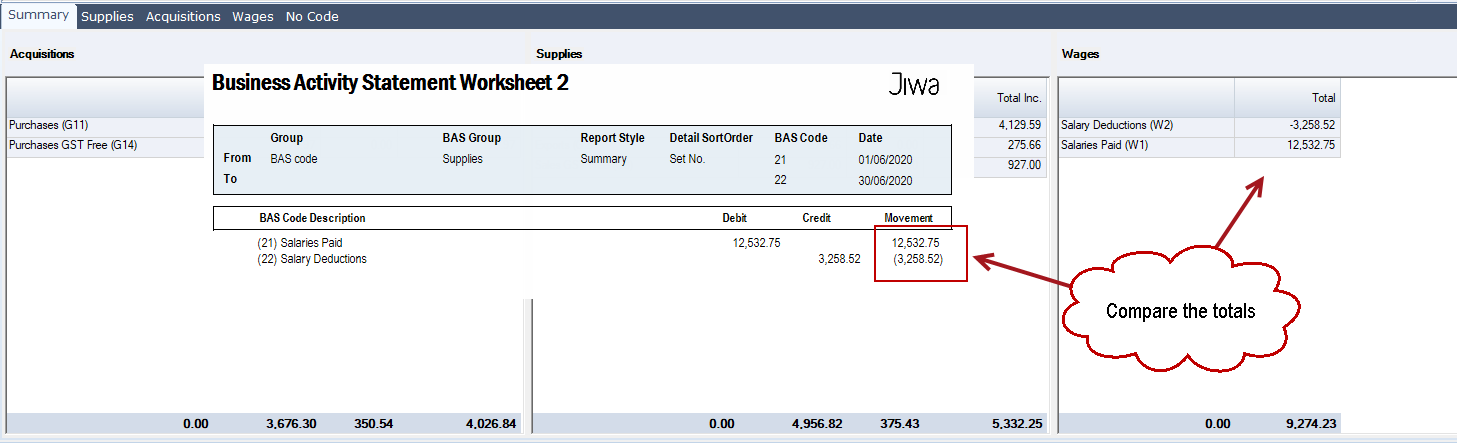

Wages

To reconcile your Wages run the Business Activity Statement – Worksheet 2 report ensuring that you set the same reporting dates.

Compare the GST code totals on the report to the summary tab of your batch.

Recording Wages

The GL Global Review utility pulls data from the various modules in Jiwa except for the General Ledger, for this reason when implementing this utility the BAS code field on journal sets has been disabled.

Any transaction that has a GST implication must be entered through one of the following modules.

- Sales,

- Purchasing,

- Debtors,

- Creditors, or

- Cashbook

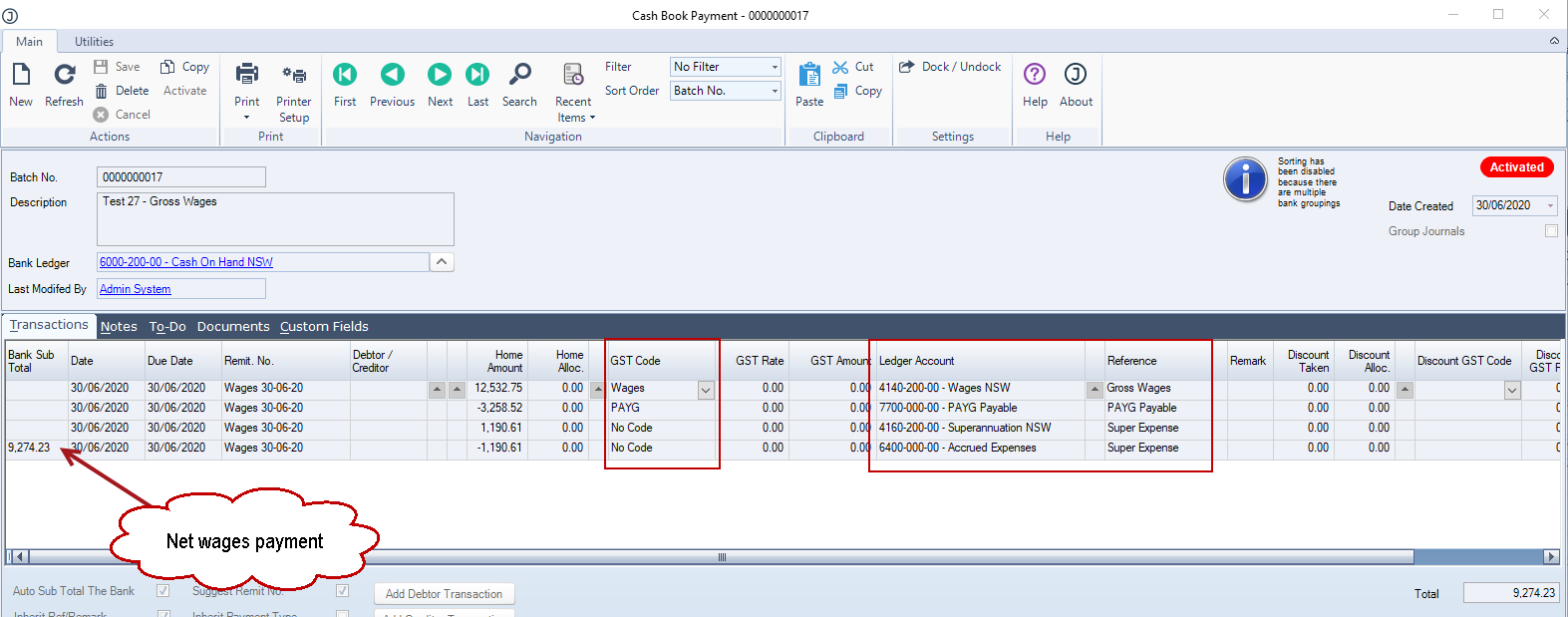

Transactions for Wages can be entered through the Cashbook Payments form. Following is an example of how wages can be recorded via the Cashbook with the correct GST codes. You will also note that we are taking up Gross wages and accruing superannuation whilst ensuring that the net payment coming out of our bank account is correct.

This video is best seen on the full screen. Just click on the icon at the bottom right of the video (see image below).

To exit full screen just press escape