This article is only applicable to those still using Jiwa 6.

For Jiwa 7 users please refer to the articles on Supplier Returns.

The procedure to return goods to an overseas foreign currency account supplier is different to accounts which are based in Australian dollars.

Basically the procedure requires you to complete the following three steps:

Supplier Returns to FX Creditor

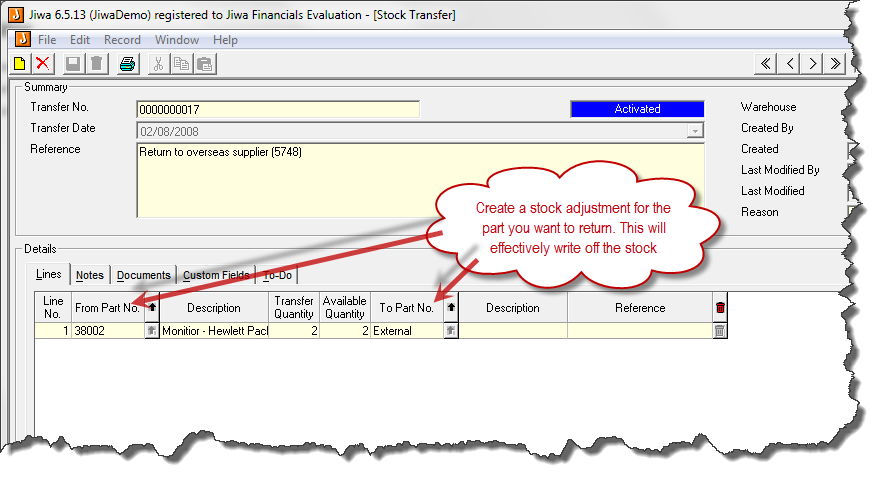

- Create a Stock Transfer Out to External – writing off the stock (i.e. removes the stock)

- Create a credit note posting to the stock write off account

- Allocate the credit against the relevant invoice

So our first step is to transfer the stock out from the stock item to “External”. Create a stock adjustment for the part you want to return. This will effectively write off the stock.